Earned Wage Access Apps Loans 2025: Instant Cash Without Fees

The financial world has changed to cater to its modern worker in 2025. Earned wage access apps loans offer as one of the biggest innovations, allowing people to access their earnings and regain control of their money without having to wait for regular paydays. These Apps provide the much-needed solution to fill short-term cash gaps by offering instant access to your already earned money, without the high costs of loans or the cycle of credit card debt. Even better? They offer advances without any hidden cost on many of these platforms.

The achieved wage access (EWA) has become one of several more intelligent/separated methods for compensating employees for availability-based work at any point in time, as they search for transitional financial tools. This guide will teach you everything you need to know about earned wage access apps loans: how they work, who qualifies for them, their benefits, and pitfalls.

What Is Earned Wage Access and Why Does It Matter in 2025

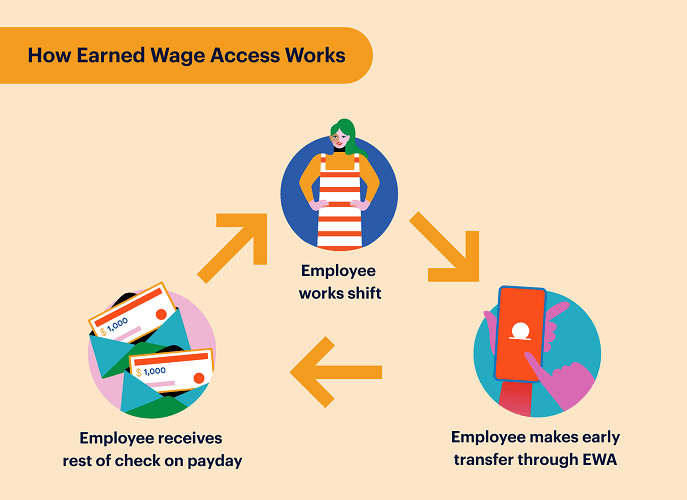

Earned Wage Access (EWA) is a financial service that allows employees to receive early access to wages they have already earned but have not yet received. EWA is not a loan—unlike a traditional payday loan or a credit-based advance for a future pay period—because this money is yours; your earned wages based on completed work hours.

Wage access has grown steadily in 2025, as workers appreciate this form of pay. The demand for on-demand liquidity without debt is undoubtedly driven by inflation and rising living costs, as well as the increasing number of workers engaged in the gig economy or flexible work arrangements. This is where EWA comes into play, giving access to wages ahead of time, instantly.

Employees no longer need to wait two weeks or more for their pay. Earned wage access apps offer instant access to your money, typically within minutes, at zero interest and with no hidden fees.

How Earned Wage Access Apps Loans Work

Employees use earned wage access (EWA) apps to access wages they have already earned before receiving their regular paycheck. Some of them work independently or in partnerships with employers. It’s simple, tech-based, and eliminates the classic nuisances of a traditional lender. Fund all majority users instantly via paperless processes. Now, let us examine the flow of the system, from earnings to instant access.

Income Tracking

With integrations to timesheets or payroll systems, the app tracks your hours or salary in real time. This way, they can accurately estimate how much you’ve earned so far. This enables secure real-time verification of income. Tracking works automatically and operates silently in the background.

Advance Request

You can request up to approximately 50% of your earned income that has been unauthorized through the app. This allows you to be flexible without having to wait until payday. That limit depends on your income and past usage. It’s a fast and hassle-free request.

Instant Delivery

Most EWA apps offer immediate withdrawals, sending the funds to your bank account or card. While they may charge a minuscule fee for immediate delivery, the standard delivery can be free. Generally, transfers take place from a few minutes to 24 hours. The request is just as easy to submit, and your funds are available to use almost immediately.

Automatic Repayment

It deducts the borrowed amount automatically from your next salary cheque. With no late fees and never missing a due date, this system is a lifesaver. It means you don’t have to keep in mind to pay back. This is automatic and has no defined repayment method.

Why 2025 Is the Best Time to Use EWA Apps

The economic changes and advances in technology made earned wage access more topical in 2025. The experience of gig economy growth, inflated expenses, and employer adoption has accelerated the use of apps. It attracts salaried and freelance workers as it is easy, and the payout system is instant. Now, let’s examine why you are at the peak moment for EWA innovation.

Increased Gig Work

The growing popularity of freelance, part-time, or on-demand jobs. EWA apps assist these workers by allowing them to access their income in real-time, concurrent with when they earn it. This support fills the gaps between pay periods typical of some types of gig work. It’s designed for the modern workforce, which is changing.

Financial Pressure

The rising inflation, hike in rent, and bills are looming for a quick remedy. During those months that never end, EWA apps provide a little breathing room. It allows users to handle other urgent expenses without fear of a late fee or overdraft, which is a clever way to tackle life in an expensive world.

Better Tech

Today, EWA platforms incorporate AI and secure automation. It enhances wage tracking, reduces fraud, and accelerates speed. As users experience less lag and increased accuracy, they trust the apps even more. Faster, smarter, and safer than ever, the all-new 2025 versions are here.

Employer Adoption

An increasing number of employers offer EWA apps as a perk by building them into payroll. It increases staff happiness, loyalty, and motivation. This has been seen as a competitive advantage for companies, attracting talent. Workers bring home fewer stressors and more financial freedom.

Top Features of Earned Wage Access Apps Loans

In 2025, we have the combination of rapid and low-cost EWA and practical financial tools services. They offer more than just cash advances, providing credit support and budgeting assistance. Search for these common features to maximise your benefit. The right app for you will be based on your financial situation and lifestyle.

Instant Transfers

Numerous apps offer users instant access to cash, with same-day delivery options. You can optimize this for emergency expenditures or immediate purposes. Some charge money, while others provide it for free. Whenever you need to, this process helps you to withdraw your money in just a few minutes.

No Interest or Fees

The easiest-to-use apps are those that offer 0% interest or no required fees. You are not paying more than you earn, unlike payday loans. Others use optional tipping instead. Transparency is a big plus.

No Credit Check

When you are accessing pre-earned wages, your credit score is irrelevant. No hard inquiries or negative file reports. It can also help those with bad or no credit. Approval is almost always guaranteed.

Budgeting Tools

Today, more EWA apps offer spending analysis tools, savings assistance capabilities, and financial planning features. Both help users break free from paycheck-to-paycheck cycles. Some apps send alerts or suggest goals. Finwell is included in the package.

Multiple Income Sources

As of 2025, some apps take gig work, SSI, and even child support into consideration. This means that more users are eligible for it. Advances are available even to non-traditional earners. It adapts to the modern gig economy.

Best Earned Wage Access Apps for Instant Cash in 2025

However, some are better than others and offer workers and employers greater relative benefits, thus outshining competition with improved app results and reviews. The best app won’t just offer fast, low-cost advances in 2025; it’ll also include budgeting tools, no credit check, or any other incentive. Here are the best-rated platforms for this year.

Earnin

Earnin offers up to $100 per day, with no fees or credit checks. While the app is known for its ethical model based on optional tipping, It is best for salaried employees who have consistent hours. Transfers are often instant.

MoneyLion Instacash®

This app offers free, flexible repayment of up to $500, including financial tools such as credit-building and budgeting, catering to users seeking a combination of banking and EWA services. Funds are available quickly.

Empower

Empower Credit Monitoring. With Empower, you gain access to up to $300, and it also includes credit monitoring. The menu of money tools unlocks for just $8 a month. Ideal for users who want to manage their money in one place. One of the most important features is to get the cash immediately.

DailyPay

DailyPay minimizes the friction associated with earned income access by partnering directly with employers and offering up to 100% of the income earned. Users have the option to transfer funds as needed. This is primarily useful for employees of supported companies. It’s secure, fast, and employer-backed.

Brigit

Brigit offers up to $250 and overdraft coverage, with no credit checks, helping you avoid bank fees. It also comes with budgeting tools, making it a stop-gap measure for cash flow shortages.

Benefits of Earned Wage Access Apps Over Traditional Loans

EWA apps change the way you access money, not via debt traps. This is a manor, not like a cash advance or charge cards – there is no intrigue, no credit hazard, and no muddled endorsements. Apps that provide more control over finances with less stress and more speed

No Interest Rates

Hungry for July insights? EWA apps are not like predatory lenders, and they don’t overcharge with an APR or a rolling fee. You pay back whatever you draw upon. This prevents the rolling snowball effect of interest rates that we see with payday loans. It’s a much safer alternative.

No Credit Risk

It doesn’t affect your credit rating. You are not taking out a loan from a lender; you are simply accessing your wages earlier. And there would be no hard pulls or display of late payments, so that it is available to all.

Fewer Fees

Generally speaking, most apps either have flat fees or offer free transfers. It is a pithy sum compared to bank fees or loan charges. Users can save while still addressing cash crunches. Some even operate on a tip basis.

Speed and Simplicity

It takes a couple of clicks, and you get your money. It’s paperwork-free, interview-free, and lengthy approval process-free. User-friendly app interface. These quick solutions breathe relief into cash flow concerns.

Common Drawbacks and How to Avoid Them

However, EWA apps are not without their downsides. Cash flow problems are caused by overusing or misunderstanding the function they provide. This could be an issue for some users who have to deal with fees or less money in their paychecks. Here’s what to look out for, and how to safeguard yourself from it.

Reduced Payday Balance

With early borrowing, your true income on payday will be smaller. If this is not planned properly, it may pose budgeting issues later on. Remember to factor future bills into your calculations. Never invest outside your means.

Overuse

A few borrowers become accustomed to the cycle of doing this every pay cycle. It creates dependency and ruins the budgeting cycle. Use it only in real emergencies. Yearning for long-term planning: Breaking the cycle

Fees for Instant Delivery

This is why many apps charge $5–$10 for an instant transfer. If you use this often, it can add up! Whenever possible, choose free standard delivery. Balance speed with cost awareness.

Subscription Costs

Apps such as Empower ask for monthly payments for access to premium features. If you aren’t taking advantage of the expensive modules, then why pay for them at all? Opt for free or pay-per-use unless the tools are worth the price.

Who Can Use Earned Wage Access Apps Loans in 2025

While some are integrated with employers, others operate independently, making them ideal for freelancers, gig workers, and part-time workers. There are some eligibility factors, but thankfull,y these services are mostly available.

- Must Have Proof Of Income: Payroll, gig, or SSI

- Regular Depository History: They need to follow up on a regular inflow of money.

- Bank Account or Debit Card: Used for transferring money and repayments.

- Must be At Least 18: Having a valid ID means you have achieved legal adulthood.

Earned Wage Access vs. Payday Loans: A Safer Alternative

Why Earned Wage Access Is Not a Payday Loan. It makes earned wage access apps a more secure and equitable method of handling situations that require quick cash.

- EWA is not a loan — you have already earned this money.

- Zero interest and credit inquiries – payday loans usually lead users to debt traps.

- Reduced Risk – EWA payments are directly deducted from your next paycheck.

Not facing legal penalties—falling behind on EWA repayments usually doesn’t have dire implications in comparison with not being able to pay a payday loan.

How to Choose the Best EWA App in 2025

Finally, review the app’s reviews and feedback from actual users to verify its reliability and operational effectiveness. Here are some of the parameters you should consider when choosing the right EWA app according to your needs:

- Cost Structure: Ensure that there are no hidden costs and no unnecessary monthly fees associated with the app.

- Speed of Payout: Certain apps are faster than others at processing payments.

- Integration: Find out which app your employer recommends for EWA if they offer it.

- User Experience — The more user-friendly the app is, the better!

- Customer Support — Excellent support is crucial in the event of problems with payment or transfer.

FAQ About Earned Wage Access Apps Loans 2025

Can I have earned wage access without going through my employer?

There are indeed many independently operated companies that offer EWA in 2025. If the app can independently verify your income source and direct deposit history, then you do not need employer approval.

How quickly will I receive the money?

Depending on the app, it can send money immediately (within a few minutes) or within 1–2 business days. There could be a minimal extra cost for instant transfer.

Do earned wage access apps check your credit score?

No, earned wage access apps do not look at your credit score. These loans are secured in that your credit history is not a factor in securing one; however, your income must be verified.

Do cash advance apps impact credit score?

Not at all. Because they do not report to credit bureaus, your score will not be affected by whether you use these apps or not.

Will earned wage access apps work for gig workers?

Absolutely. These days, gig income from services like Uber, DoorDash, and freelance platforms can easily be linked to your bank transactions in many apps.

Final Thought on Earned Wage Access Apps loans 2025

Workers need financial tools that meet their lifestyle in the on-demand world we live in today. Apps looking to provide earned wage access loans have been a part of that solution in 2025, providing the fastest, fee-free access to wages you already earned. Boasting features like no credit checks, no interest, and on-demand delivery faster than a Flex Seal infomercial, these apps are lending a serious hand, and keeping us out of the red with our bills, saving our butts in a pinch or two, and trumping financial stress as a whole.

However, the key is smart usage. Use reputable applications, familiarize yourself with the terms, and only access what you need. EWA is a modern-day solution to an age-old problem: the monthly wait for payday, and when used strategically, it can be a lifesaver.